Part 7 – The Grid

During our time in Fukushima, we heard a lot from residents about what the future of their energy industry will look like. There is, understandably, a strong push to remove nuclear energy from the grid altogether, but there are barriers to making that a reality. More than once we heard references to Germany and their simultaneous shuttering of conventional generation sources and accelerated roll-out of renewable energy. The mentality of many Japanese people is “if Germany can do it, so can we.” In this installment of this series, we will take a look at the feasibility of such major fuel shifts in Germany and Japan.

Japan’s electricity grid

Prior to 2011, nuclear made up one third of Japan’s electricity generation. All of the country’s 54 reactors were shut down immediately after the incident, but demand has since necessitated bringing nine of them back online, after extensive safety testing. The conservative government currently in place under Abe Shinzo is pushing for nuclear to rise to 20-25% of the country’s grid mix by 2030. There is also a push to ensure growth of renewable energy as well, increasing to a possible 22-24% of generation by 2030 (up from its 17% in 2018).

The country is keen to achieve reductions in carbon dioxide emissions, and Abe sees nuclear as a way to reach that goal. However, the new minister of the environment Koizumi Shinjiro says that all nuclear must go to prevent a repeat of Fukushima Daiichi. Meanwhile, Japan is coming under continued international criticism over its dependence on coal and natural gas imports. According to The Guardian, “Japan is the third-biggest importer of coal after India and China, according to the US Energy Information Administration. Its megabanks have been urged to end their financing of coal-fired plants in Vietnam and other developing countries in Asia.”[1]

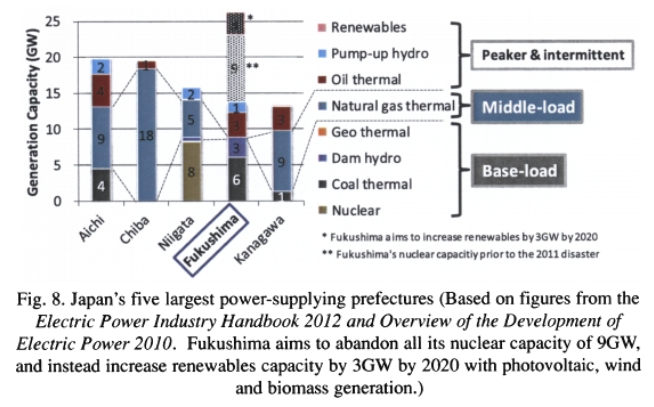

Image credit: [2]

Despite the heavy fossil fuel imports, when I lived there I felt like I was more exposed to diversified energy generation than I had been in the US. The first time I ever saw a bank of wind turbines was driving along the highway past Lake Inawashiro in the middle of the prefecture. My apartment was four kilometers from the Shingo hydroelectric plant, which is one of the largest in the region. On our recent trip, while sightseeing with my Japanese parents, I discovered the Yanaizu-Nishiyama geothermal plant (the largest in Tohoku, at 65 mega-watts) 45 minutes from my hometown of Nishiaizu.

In researching for this post, I found that it wasn’t just my perception: Japan’s grid was more diversified than that of the United States while I was there in 2006 to 2008. The combination of coal, natural gas, and crude oil at the time made up approximately 60% of Japan’s grid mix; that same combination of fossil fuel sources was approaching 80% in the US. At the same time, nuclear made up approximately 25% of Japan’s mix, twice what was in use in the US. Being on an island is difficult, though – everyone needs to make use of what resources they have when a vast continent of plentiful coal, oil, and gas reserves isn’t part of the equation. (You may recall from previous posts on this blog that my personal awakening to individual environmental action was in Japan, sorting my trash into no fewer than seven different categories.)

Energy generation in Fukushima

In 2009, Fukushima exported over 100 Terawatt hours (trillion watt-hours) to other prefectures after covering its own demand of 15 TWh. Even after all nuclear generation was taken offline in 2011, Fukushima remained among Japan’s top four energy-producing prefectures. In fact, Fukushima’s hydro and geothermal infrastructure were key to the energy diversity that supported grid reliability after the earthquake.

Image credit: [3]

The prefecture is perfectly-situated for a broad range of electricity generation: it has powerful rivers for hydroelectric, plentiful hot springs for geothermal, windy highlands for wind turbines, and large coastal ports for coal and liquid natural gas (LNG) imports. Because of the natural resources, topography, and geographic location of the prefecture, a 2013 study posited that Fukushima can remain a literal powerhouse for the country, with or without nuclear returning to the grid.

When it comes to building out renewable energy, the Aizu region of Fukushima is already one of the country’s leading areas for utility-scale hydro power. A feed-in tariff system was introduced post-earthquake, allowing small generators to be reimbursed for electricity supplied to the grid, so additional renewable generation, including a biomass facility in Aizu, began to come online. The area is also known for its volcanic activity, with some of the best hot springs resorts, or onsen, in the country (and therefore potential for increased geothermal development).

It is puzzling that a volcanic island doesn’t make more use of its natural resources. Japan, a country of 126 million, currently has 500 mega-watts of geothermal generation capacity installed, making up 0.2% of its overall grid mix. (For comparison, Iceland, with a population of 300,000, has 665 MW of installed geothermal capacity and uses it to run an aluminum smelter.) Japan wants to increase geothermal capacity to 1% of the grid mix by 2030, and some sources say it has the potential to make up 10% by 2050, but there is opposition.

The first reason why geothermal power is not more prevalent across the country is that many promising locations happen to be situated in national parks. However, “after the earthquake, … the Japanese government revised geothermal development regulations in national parks” enabling more opportunity for geothermal power.[4]

The second reason is the onsen lobby. The entire industry is highly-regulated: exclusive spas and public bath houses alike need access to volcanic water, of a certain temperature, containing certain quantities of specific minerals in order to be allowed to use the term onsen. (And yes, there are Japanese tourists who travel the country to dip themselves in all the famous ones.) Onsen operators are not about to risk their business model, claiming that geothermal plants can diminish the supply and possibly impact the temperature of the volcanically-heated water.

On top of that, between high costs of geological surveys, exploratory drilling, and construction of the plants, which requires boring down several kilometers into the Earth’s crust, the pricetag of a geothermal plant is about three times that of a coal-fired plant. Although there is a clear benefit to this type of clean energy, it is an uphill battle to create more capacity.[5]

Germany’s Grid

The way to get around public debates and market resistance is to go the route of a government mandate, like what we’ve seen in Germany. Multiple times during our tour of the Fukushima Exclusion Zone, we heard people reference Germany’s switch to renewables. However, we wondered if Japan could be as successful in that transition as Germany. The biggest issue we saw is Japan’s isolation from neighboring electricity grids, but for the sake of argument, let’s take a minute to look at Germany’s transition.

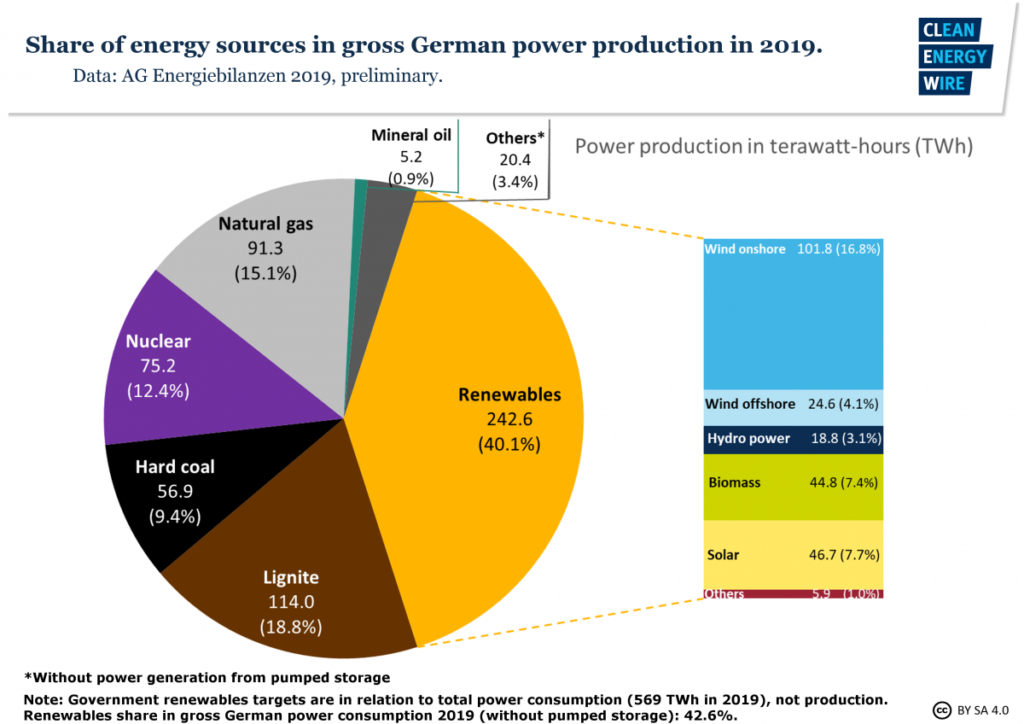

Image credit: [6]

In the wake of Fukushima Daiichi and climate change, Angela Merkel’s government decided to abandon all of their nuclear and black coal generation by 2022. In fact, Germany shut down its last black coal mine in 2018 and transitioned all miners to new jobs (with training) or early retirement. It is expected that the transition to support coal job replacement will total €40 Billion.[7]

Germany currently generates so much electricity that it serves as a net energy exporter to the European Union, providing about 20% of the EU’s total (with France up there as well at 17%). By completely retiring these two baseload energy sources, Germany will lose 12.5 Gigawatts (billion watts) of generating capacity from coal and 10 GW from nuclear. Some forecasts predict reliable energy supply falling as much as 5.5 GW below Germany’s peak demand in 2021. Any supply shortages in Germany would mean shortages in other countries as well, such as Austria, Switzerland, Poland, and the Netherlands.

According to local utilities, unfavorable situations have not been sufficiently stress-tested, and infrastructure improvements are “years behind schedule.” Industrial customers are becoming nervous about intermittent electricity supply, and one organization is making noises about shifting operations overseas, specifically to the United States where grid conditions are “more favorable.” (It’s not a huge leap to connect the dots between “favorable” conditions and our fossil-based electricity generation.) German utilities aren’t happy about this possibility either: RWE, Germany’s largest utility, has asked for compensation to make up for the financial hit of plant closures.

Meanwhile, France’s grid mix is very heavy on nuclear, which provides reliable baseload power in and outside of France. However, their nuclear fleet is aging quickly, and reactors will start aging out of service. Additionally, with summer temperatures trending upwards, energy demand for cooling buildings is expected to increase as well. Last summer France was not able to export as much electricity as projected because of increased domestic need.[8]

Image credit: [9]

Germany’s energy transition is expected to cost as much as $4 Trillion by 2050, and many sources anticipate supply shortages, not just for Germany, but for the other countries that count on German-produced electricity. Any supply gaps will need to be offset by either purchasing electricity from other countries (like nuclear-heavy France) or by importing fossil fuels, such as oil from the Middle East or LNG from Russia or the US.[10]

Many experts agree that fossil fuels must come offline to combat climate change, but the question remains: what will provide reliable, zero-carbon baseload power without nuclear? In our final installment next week, we will bring the question back to Japan and weigh the economic, environmental, and human factors of that question.

Thank you for reading.

[1] https://www.theguardian.com/environment/2020/jan/05/fukushima-unveils-plans-to-become-renewable-energy-hub-japan

[2] https://www.eia.gov/international/analysis/country/JPN

[3] https://www.jstor.org/stable/43735193

[4] https://www.jstor.org/stable/43735193

[5] https://www.japantimes.co.jp/life/2019/03/09/environment/unlocking-japans-geothermal-energy-potential/#.Xpta5upKipo

[6] https://www.cleanenergywire.org/factsheets/germanys-energy-consumption-and-power-mix-charts

[7] https://www.abc.net.au/news/2020-02-18/australia-climate-how-germany-is-closing-down-its-coal-industry/11902884

[8] https://www.reuters.com/article/us-europe-power-supply-insight-idUSKCN1UD0GZ

[9] https://www.renewable-ei.org/en/activities/column/20180302.html

[10] https://www.forbes.com/sites/judeclemente/2020/03/08/germany-proves-how-essential-natural-gas-is–and-the-us-must-supply/#f16b55c2c215

0 Comments